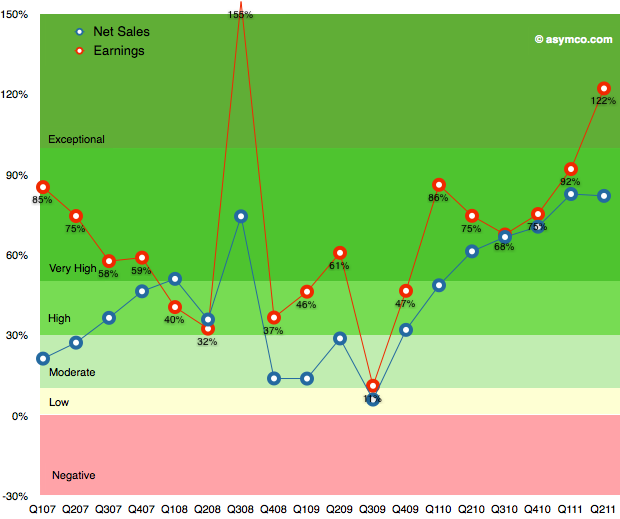

Here is the Apple growth scorecard from www.Asymco.com

http://www.asymco.com/2012/01/...

Often times we hear reasons why high growth can’t continue. The arguments sound something like this:

Tracking percentage growth and assuming it will continue is pretty naive, as there are only X number of people on the planet that can afford an iPhone/iPad and that number is not growing at these rates! While the growth rate may be in line with historic figures, clearly the growth has to slow down….

Catalysts for Growth:

Lower priced iPhones can generate large incremental growth. Similar for a lower priced iPad. Important in developed markets, very important in emerging countries.

The iPhone is generating a halo effect and introducing new Apple consumers to iPods, iPads, and Macs.

In the short run, new Mac, iPhone, and iPads models stimulate new demand and upgrades from current customers.

Also have the 4G LTE iPhone upgrade cycle to look forward to.

A growing tablet market with fast growing functionality, such as, textbooks and in-flight uses, new business uses, and wider acceptance by education.

Apple TV in the not to distant future

Improving gross margins caused by iPad and iPhone volume

Potential for dividend or share buyback with the excess cash as it grows ever faster.

Expanding distribution in china. China projected to surpass the US as the largest Apple market in several years. (China grew from $3 billion in FY10 to $13 billion in FY11)

Strong demand for iPhone 4S in China and stronger demand for a lower priced iPhone.

Expect to see China Telecom and China Mobile as iPhone distributors in the next year. They represent roughly 9 times the smartphone market that China Unicom currently provides Apple in China.

iPhone 5 is anticipated to be compatible with China Mobiles upcoming 4G network.

Potential for 60 million iPhones to be sold annually in China in several years.

RIM is still broken and trying to fix itself, ripe for more market share loss.

Nokia is struggling.

All of Microsoft is now smaller than the iPhone they poo-poooed in 2007.

Emerging markets represent large future growth opportunities. Asia has 655 million adults age 25-34.

Android has ramped up well in sales, but hasn’t put pressure on Apples ASP or margins.

New iPhones accounted for more than ½ of Verizon and AT&T smartphone activation in 2011. (future upgrade consumers)

Apple expanded from one carrier in 2007 to 220+ carriers in 105 countries in 2011. iPhone shipments rose from 4 million in CY07 to 93 million in CY11.

Given these factors, a strong case can be made that Apple shares discount (take into account) a significant deceleration in growth that is not justified given the short-term and long-term growth factors.

Yes the iPhone can't continue to grow at 100% every year indefinitely - but even if it only continues for another 1, 2, or 3 years, and then level out to 'standard' 20% growth (conservative), the implications for apples revenue & earnings are gigantic.

Some other fun factors:

Good smartphones reduce the need for a landline, helping to fund the smartphone.

More benefit from the overall Apple echo system as Mac sales increase and integrated cloud services arrive such as Siri.

New products we don’t even envision today. Apple TV or iTV is discussed a good deal, but what are the next 2 or 3 products after that?

If people value something highly enough, they will find a way to purchase it.

Value - not price - is what matters.

Economies of scale - for all iOS products, iMacs, and MacBooks, increasing production and sales are very positive for bottom line profits. Fixed costs are fixed (up to the point you need another factory, etc) and each additional product only incurs the variable costs of production.

Gross Margins can continue to grow as fixed costs are spread over a vastly larger number of units.

Larger volumes mean greater discounts from suppliers.

Large cash reserves allow for large, discounted purchases, special deals, and locking in a supply of new or rare parts.